The TNRD board has finalized its five year fiscal plan, as well as this year’s budget, which is going to require a sizeable tax increase.

The overall tax increase needed to continue funding the services the TNRD offers — 7.05-percent.

However, Chief Financial Officer Carla Fox pointing out to the board that this doesn’t mean that everyone will take the same hit.

“There’s many factors that impact whether your taxes are going to go up or down,” noted Fox as part of her presentation to the TNRD Board on Thursday. “It’s hard to bring an impact [analysis] …you have to do it on a per-average basis.”

The calculating of the amount individual home owners pay will include the assessed value of your home, as well as which part of the regional district you live in.

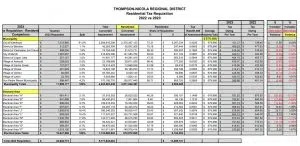

Explainer of the TNRD property assessment guidelines for tax implications/via TNRD

The Regional District has provided a broad outline of what homeowners can expect this year when their assessment notices are issued.

2023 tax assessments for each part of the TNRD based on average home values and locations/via TNRD

The main driver behind the need for the 7.05-percent tax increase is being viewed as inflation, on top of insurance costs and labour contracts.

However, the TNRD notes not everyone will be facing a sharp increase this year.

“Despite increases in costs to provide services, residential landowners in many communities may pay less tax to the TNRD compared to 2022,” said the TNRD in a news release following the approval of the five year financial plan. “This is due to a combination of factors, including new growth to spread amounts owing to a larger tax base. In 2023, the total taxation amount collected by the TNRD is $25.1 million, which represents a 7.05% increase from 2022, however, many residential landowners can expect to see a smaller increase or a slight reduction in property taxes owing.”

The tax increase projections beyond this year hover in the 2 to 4-percent range.