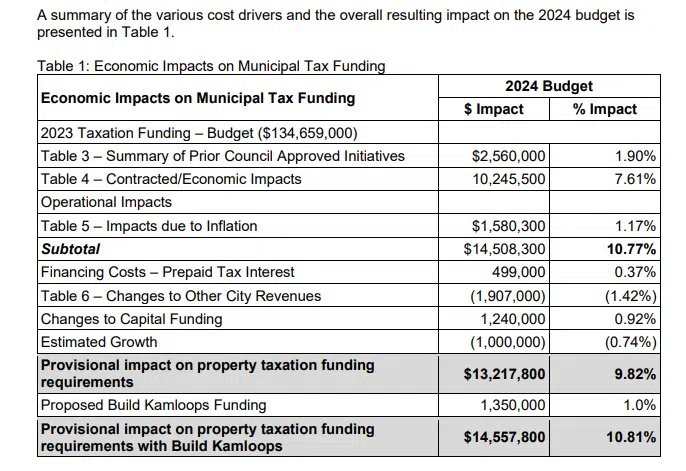

Kamloops taxpayers could be faced with a 10.81 per cent increase in property taxes in 2024.

That is according to a report going before Tuesday’s Committee of the Whole meeting.

“As the City prepares the 2024 budget, the community and the organization are facing similar challenges to those faced the prior year,” a report from Corporate Services Director David Hallinan said.

“There are lingering effects from the COVID-19 pandemic. Increased competition for skilled employees, continued supply chain issues, and the high level of inflation in the market all continue to be unpredictable and impact many of the City provided operations and services.”

- Summary of the 2024 Kamloops provisional budget. (Photo via City of Kamloops)

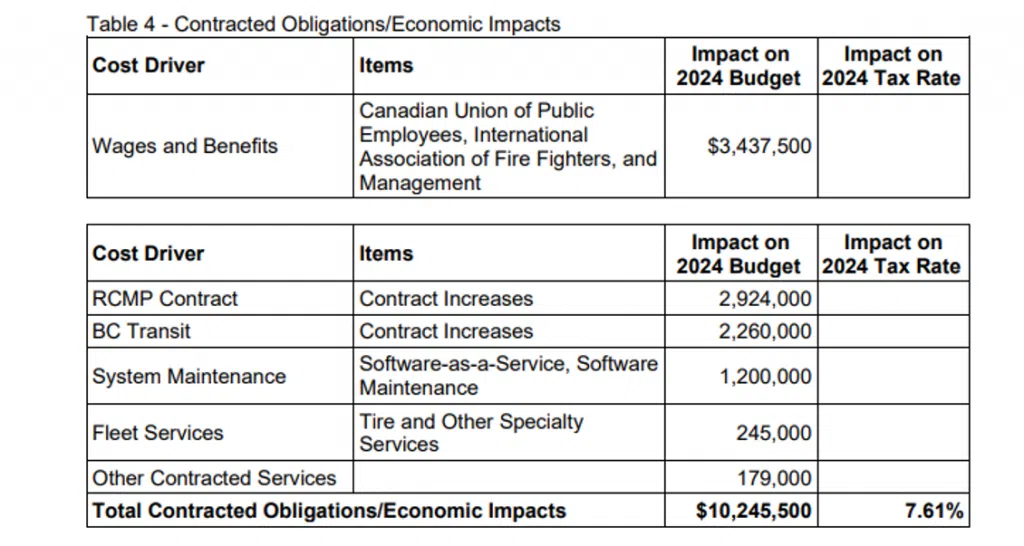

Much of the increase – about $10.2 million or a 7.61 per cent – is due to contracted or economic impacts. That includes employee wages and benefits, RCMP and BC Transit contracts, system maintenance, and the City’s fleet of vehicles.

“What we are seeing I guess for lack of a better term is sort of the inflationary hangover,” Hallinan said on NL Newsday. “And so doing some environmental scanning and market scanning, what we’re seeing is a lot of the contract negotiations are looking to catch up to what happened over the course of 2023.”

Hallinan says contracts with three unions – CUPE Local 900 that represents city workers, IAFF Local 913 which represents firefighters, and the National Police Federation (NPF) which represents RCMP officers – look to address a rising cost of living amid high interest rates.

The IAFF contract expired in 2021, the NPF contract expired in March 2023, and the CUPE contract expires on Dec. 31.

“We are seeing some really big numbers coming forward in terms of the contracted services portion that the City relies on to deliver some services,” Hallinan said.

- Breakdown of contracted obligations in the 2024 provisional budget. (Photo via City of Kamloops)

Hallinan says the city’s share of the annual RCMP contract will go up by about $2.9 million in 2024 to $33.79 million. He says funding for policing, which includes including the RCMP municipal employees, is the City’s largest tax-funded expense.

The BC Transit contract increase amounts to just under $2.3 million, with the City also putting aside about $3.4 million anticipating an increase in wages and benefits for CUPE and IAFF employees.

“Negotiations are starting to pick up speed but we have some time between now and the budget being finalized,” Hallinan said. “So we do have time to make some changes to this. That is one of the things the finance team does quite diligently.

“We are constantly looking at this and we are checking back on a lot of our assumptions and revisiting them all the way through until we get to the final budget, which will be, I believe, towards the end of February.”

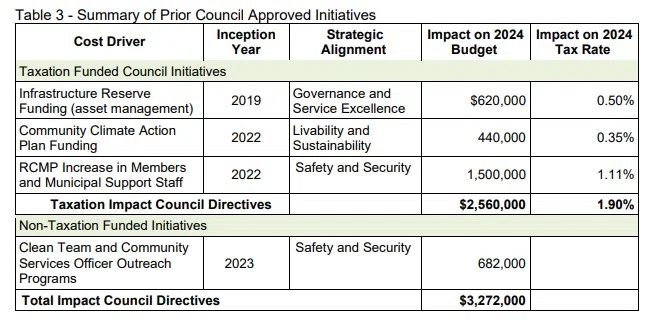

Another 1.9 per cent increase is required to fund previously approved council decisions – like the hiring of more RCMP officers and boosting the city’s infrastructure reserves.

- Breakdown of council directives and impacts to 2024 provisional budget. (Photo via City of Kamloops)

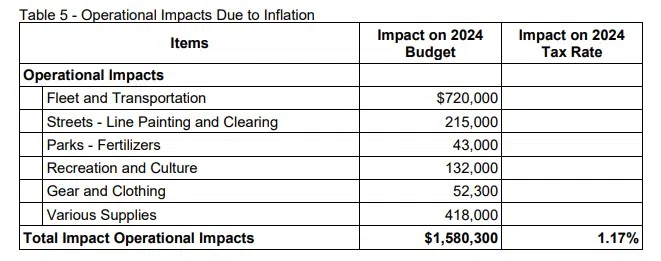

The City is also expecting to need an extra $1.5 million to cover increased levels of inflation along with supply chain issues continue that continue to be felt. Most of that is to do with the city’s fleet of vehicles as well as the availability, acquisition, manufacturing, or delivery of the materials like road paint and fertilizer needed to support most civic operations.

“Since the beginning of the COVID-19 pandemic in spring 2020, City operations and service delivery have been anything but normal,” Hallinan said.

- Impacts of inflation on 2024 provisional budget. (Photo via City of Kamloops)

City council could also choose to add $1.35 million to the Build Kamloops fund, which is meant to try and fast track some of the goals in the Kamloops Recreation Master Plan. If they don’t, the provisional 2024 tax rate drops to 9.82 per cent.

Hallinan says that fund is intended to support future debt repayment that would be required to finance the Build Kamloops plan.

Earlier this week, Hallinan told Radio NL that it was “going to be a tough year” based on what City staff were seeing in other municipalities.

“It is important to note that this is the provisional budget. This is not the final budget,” Hallinan said. “Right now, BC Assessment is still working though the impact of growth on the community and how much new taxation is coming from the new houses that are being created.”

Kamloops taxpayers saw a tax increase of 6.81 per cent this year.

They were faced with a 4.92 per cent property tax increase in 2022 – then the largest in recent history – just one year after a 0.93 per cent increase in 2021 – the lowest property tax increase in about two decades.

At this time, it is not clear what the supplemental budget will look like. Those items will be brought forward in February, and it may require additional tax revenue.

People will be to have their say at a public budget meeting on Thursday, Nov. 30 at the Sandman Centre. There will be a second public budget meeting – likely in February – with City Council then expected to set its final tax rate in the spring.

The City is required to submit its finalized budget to the Province by the middle of May, with property taxes typically due in early July.

You can read Hallinan’s full report here.