Cover page of 2024 Housing Needs Report/via City of Kamloops

A new report presented to Kamloops Council on Tuesday is projecting the city is going to see a sizeable population upswing in the next 17 years, putting additional strain on the housing sector — particularly for those who are just starting out, or trying to find an initial place to live as they settle into Kamloops.

Based on projections from the 2024 Housing Needs Report assessment, Kamloops is going to need well over 23,000 new housing units built to keep up with population demands.

Of the 23,228 new units the Report says is needed by 2014, as many as one-third of them — 4,648 — will probably need to be rentals to keep up with non-market housing demand.

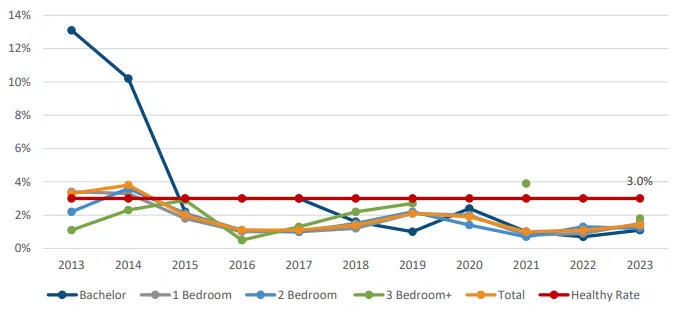

The 4,648 figure is based on expectations Kamloops would want to maintain a “healthy” vacancy rate of 3%, which is the estimate needed to keep rental rates stable in a market.

The Kamloops rental market has not seen a 3% vacancy rate for many years.

Graph charting vacancy rate for purpose-built rental units in Kamloops from 2013/via Housing Needs Report

Starting in 2014 and continuing through last year, vacancy rates have been hovering in the 1% to 2% range across the board, from bachelors to three-bedrooms.

The Housing Needs assessment does not provide any specific factors which are putting added pressure on the rental market, other than higher housing prices — which tend to keep younger people in the rental market longer — on top of general population trends.

The median rental rate in Kamloops in 2023 among bachelor, one, two and three-bedroom units was $1,296.

Kamloops likely to remain “landlord” market

While the City’s Housing Needs assessment does not provide any specific projections for rental market rates in Kamloops, the general trends does point to even more costly rents in the future.

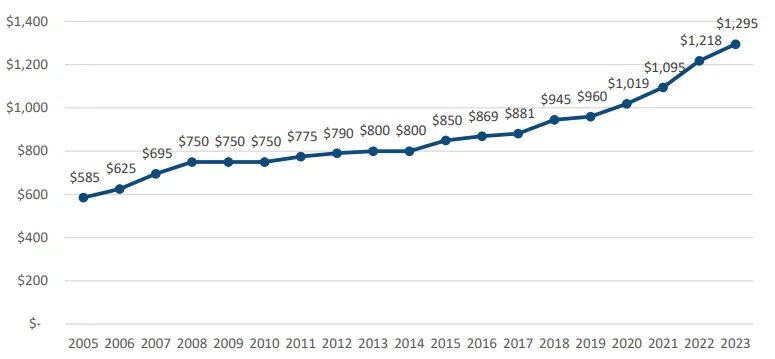

The current demands for higher rents in Kamloops can be traced back almost a full generation.

Stats show a 19 year old in Kamloops right now — born to parents who were renting a two-bedroom apartment at the time — can expect to be paying at least twice what their parents were per month in rent, even factoring in historical inflation.

The Housing Needs assessment shows the average cost for a two-bedroom, purpose-built rental unit in Kamloops in 2005 was around $640/month.

Graph representing median rent increases for the purpose-built rental market in Kamloops/via City of Kamloops

A child born into that apartment would now be expected to pay just over $1,400/month for the same unit.

Needs assessment analysis shows rental rates in Kamloops for a two-bedroom have risen 120.5% from 2005 — the lowest rate of increase among the rental sizes reviewed.

The cost to rent a one-bedroom in Kamloops has jumped 128.2%, a three-bedroom is 129.5% more costly than it was 19 years ago, while the average monthly cost of a bachelor apartment in Kamloops is a staggering 171.7% more expensive to rent now than it was in 2005.

“The total median rent across purpose-built rental units has steadily increased by 121.4% from a median rent of $585 in 2005 to $1,295 in 2023,” noted the City’s Housing Needs Report. “Increases in rents have been well above the rate of inflation, which was 47.6%, suggesting that rental housing affordability eroded over the 18 year period.”

Builders focus on homes

What may be driving up the rental prices in Kamloops is a reliance on what’s termed the “secondary market.”

These are rentals people find in non-purpose built locations, such as basement units, secondary suites and mobile homes, as examples.

The Housing Needs Report shows the secondary suite market is the biggest source of rentals in Kamloops.

While no observations are provided in the Housing Needs Report as to why that continues to be the case, a lack of available purpose-built units would likely be why.

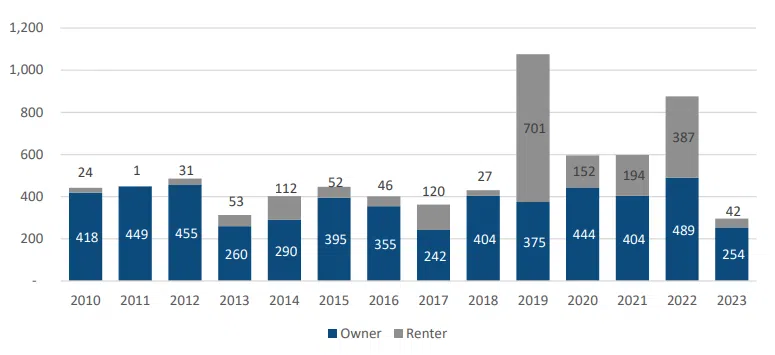

Stats do show a lack of interest by larger developers to get involved in purpose-built rentals.

Back in 2010, just 2 of the 559 housing units started that year were specifically for renters.

The Housing Needs assessment does suggest that trend may be changing, pointing to recent years — such as 2018 — where more rental units started going up than market housing through the year.

However, the longer-term trend since 2010 has been a 80-20 split — 79.5% — in favor of market housing builds compared to rental units.

Graph showing rates of market housing (blue) against purpose-built rental units (grey) year over year in Kamloops/via City of Kamloops

If this trend is going to continue, it will be able to keep the secondary market as the stronger option.

Of the estimated 11,940 units which were rented in Kamloops last year, around 61% were classified as coming from the secondary market, which does have some advantages.

Trends in the larger cities in recent years have seen rental rates in the secondary market remain more steady compared to the purpose-build sector, particularly as the ownership of the big apartment blocks attempt to recoup costs from the developments, which can artificially inflate prices.

But one of the wild-cards in renting from the secondary market, particularly in Kamloops, is the lack of information about rental rates, as the CMHC only monitors secondary rental costs and vacancy rates in the largest urban centers in Canada.

Renting from private owners can also be less stable, where owners of purpose-built units are generally under more regulatory scrutiny and are more likely to follow the law when it comes to issues such as rent increases.

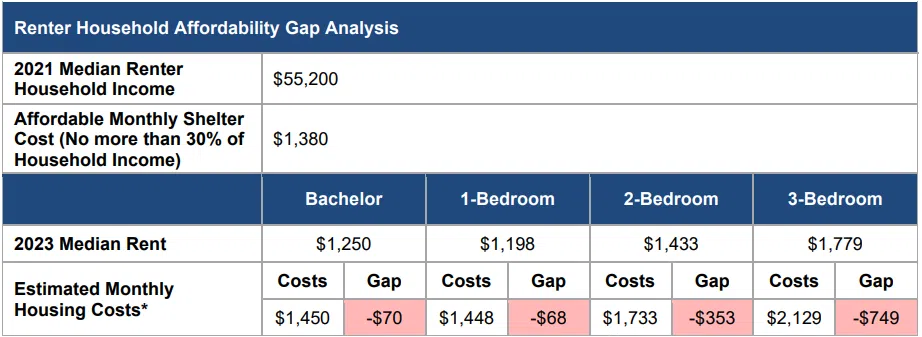

Rental rates are going to be one of the biggest challenges in the Kamloops market, as the Housing Needs Report notes that many are already renting in Kamloops are paying above the recommended level of 30% of your monthly salary.

Rental household affordability analysis for 2023/via City of Kamloops Housing Needs Report

With the rental market very sensitive to swings in supply and demand, population trends indicate it’s going to become more challenging — and potentially more expensive — for renters moving forward.

“The total share of renter households is slowly increasing, going from 26.6% in 2006 to 29.9% in 2021,” noted the Housing Needs assessment.

Adding to that pressure, population growth projections of around 1.5% per-year.

With a population estimate of 107, 941 in Kamloops this year, a 1.5% average population growth rate would push the population of Kamloops to 140,281 by 2041.