The City of Kamloops is gearing up for an influx of inquiries from locals as the Province prepares to add Kamloops into the speculation and vacancy tax initiative.

“This is completely a provincially-led, provincially-driven activity,” noted Corporate Services Director Dave Hallinan in conversation with Radio NL. ” But we suspect that we’re going to have a lot of our residents asking for clarification and questions.”

“We’re going to start putting together some FAQ’s [frequently asked questions] and some things around… here’s sort of what you need to know, what you need to do,” added Hallinan.

The BC Government confirmed this week that Kamloops will be among 13 cities added to the Speculation Tax system starting in 2025.

It’s a move which did not come unexpectedly, as the BC Government had previously announced Kamloops was going to join the list of 46 municipalities which already fell under the rules, which were first introduced in 2018 as a way to try to curb market speculation, as well as the the use of the BC property market as a tool to launder money.

Now-retired BC Finance Minister Katrine Conroy announcing expansion of speculation and vacancy tax to 13 more communities, including Kamloops, Nov. 22, 2023/via BC Government YouTube

In confirming the expansion of the “spec tax” into Kamloops, the BC government contends the vast majority of home owners will not be impacted.

“More than 99% of property owners who live in B.C. remained exempt from the tax in its sixth year,” said the Province in a release reaffirming Kamloops’ participation next year.

In making its case, the BC Government argues the tax ends up as a net benefit for communities involved.

“Money raised from the tax goes directly toward affordable homes in the regions where the tax applies,” claimed the government. “In 2023, $75.2 million was raised by the tax. In 2023-24, the B.C. government invested $1.8 billion toward housing in the SVT specified areas.”

Regardless of whether home owners in Kamloops end up paying into the program or not, everyone who owns a home will have to be an active participant.

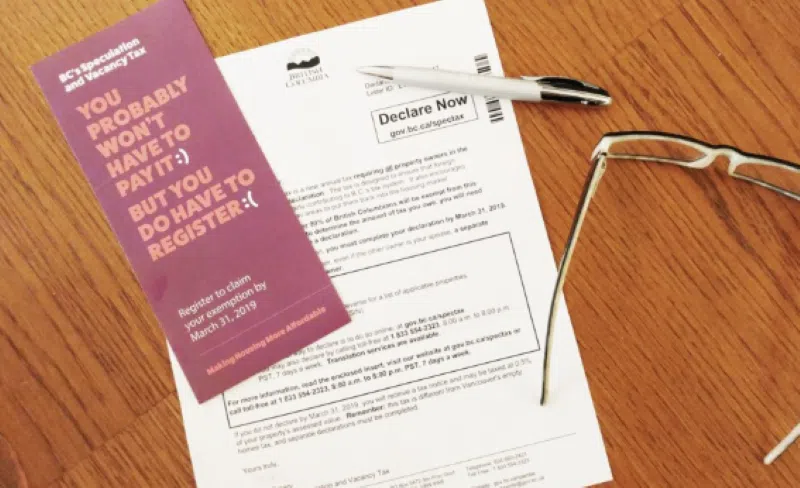

Those listed as owners on their titles will be getting letters in the mail shortly after January 1st, 2025, requiring a declaration on the status of the home.

That declaration — to be filled out every year from now on by everyone listed on the property title as owners — requires a statement on the status of the home.

If it’s your principle residence, expectations are you will be exempt from the tax.

Those who own more than one home in Kamloops will have to go through a much more rigorous process to prove they should not be subject to the tax.

City of Kamloops to help, despite lack of involvement

While the process is meant to be at arms-length of the municipalities involved, Hallinan says they are anticipating a fair amount of inquiries from local owners who are unfamiliar with the impending changes.

He says the City doesn’t actively keep track of who may own more than one property in Kamloops, but says there will be some who will — potentially — be subject to the new tax hit.

“If they [secondary homes] are vacant, then all likelihood there will be a fee for that vacancy piece. If you’re renting, I don’t believe there’s [going to be] any problem with it,” said Hallinan. “The City, however, really is not involved.”

BC NDP Leader David Eby announcing his intention to increase the rates for those who are subject to the speculation and vacancy tax/via YouTube

Declarations sent out by the Province are due March 31st of each year, and can be mailed in or submitted online.

Those who fail to make the declaration by the deadline will automatically be subject to the tax hit, and will have to prove there are extenuating circumstances to avoid it.

In pointing out his office’s non-involvement in the “spec tax,” Hallinan says there are no expectations the City may be asked to take on an investigators role, should the BC government have any questions about a home owner declaration in Kamloops.

“I think they’re going to go with the ‘we’re going to trust people with their responses’,” said Hallinan. “We see the same thing with the Home Owners Grant, where people fill out the Home Owners Grants. Province has a declaration. They will do the odd inspection, periodically. I would assume that sort of the same group is going to be looking after those types of things.”

Those who can’t get an exemption to the new tax will face a financial hit based on the value of the home they own.

For Canadian citizens or permanent residents, the maximum — for now — is 0.5% of the assessed value of their home.

This would amount to a tax bill of $3,390 for a secondary home worth $678,000, which is the average assessed value of a home in the city in 2023.

Those without a Canadian passport can be hit with a 2% tax hit on that same assessed value, which would come in at $13,560 per year — due the first business day of July.

Already a sizeable hit, expectations are those penalties are going to increase, as Premier David Eby pledged during the election to raise the rates even further.

Should he follow through with the October campaign pledge, Canadian’s with 2nd homes which don’t qualify for exemptions will be hit with a 1% levy, while the cost for foreign ownership would go up to 3%.