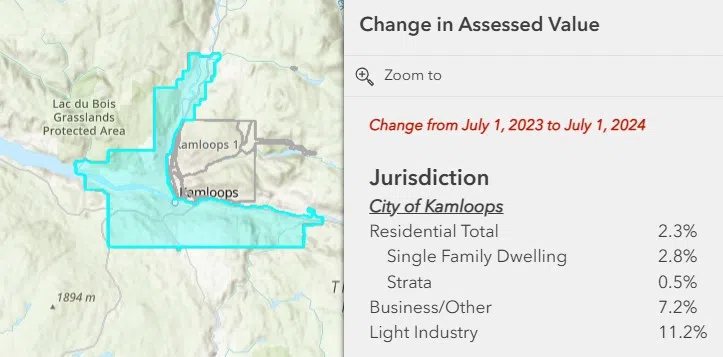

2025 property assessments, which reflect market value as of July 1, 2024, have been announced for property owners of nearly 445,000 properties throughout the Southern Interior, which includes Kamloops.

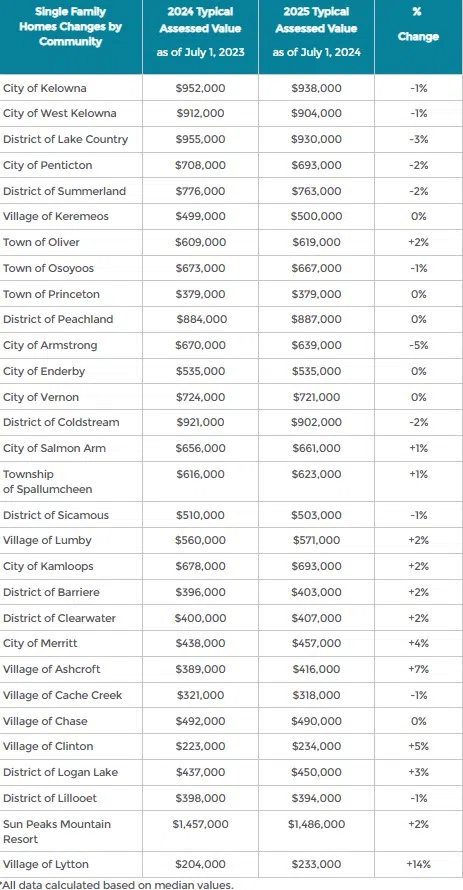

The average single family home in Kamloops is valued at $693,000, an increase of 2%.

Boris Warkentin is a Deputy Assessor with BC Assessment. He says the assessed value for each property within the province is used by the local and provincial taxing authorities determine what taxes are payable for the current year. “So for 2025 the assessment notice that is in the mail right now or arriving at your doorstep today reflects the value of what we believe your property would have sold for if it was for sale in July 1 of 2024 so we’re looking backwards in time about five months.”

Warkentin says the window is now open for people to challenge the values that have been determined. “So what we’re doing is that we want to make sure that property owners are aware that these things are coming out. There is a statutory deadline to question or submit an appeal or notice of complaint by the end of January. That’s January 31 and we want to make sure it’s right.”

He notes that there are a few different reasons why people may want to challenge the assessed values of their home. “We’re getting more and more people coming in and saying, We think our assessment is too low. You know, things that are people are reconsidering, are refinancing, and banks are starting to put more and more emphasis and reliance on DC assessments valuations. So people are really want to make sure that the value is as realistic as possible, especially in the middle of refinancing. Now, from our perspective, we can certainly understand from a homeowners that they want to have the value either higher or lower. BC assessments goal is simply to get it to be the correct value.”

“Over 98% of our assessments go unchallenged. So we’re talking a very small percentage of property owners who feel that a assessment is actually not reflective of value.”

How will this impact your property taxes? Well, Warkentin says it doesn’t necessarily translate into a tax shift. “Because what happens is that municipalities make a determination of what their budget is for that upcoming year, and then divide that by the total amount of the assessment and to arrive at what they call the mill rate. Now that’s a real simplified way of looking at it.”

“When you look at your assessment, if your assessments changed by a few percent, either up or down, which is typical for what’s happened in the Kamloops area, that does not necessarily translate into a direct change in your in your taxation.”

As B.C.’s provider of property assessment information, BC Assessment collects, monitors and analyzes property data throughout the year. The newly released 2025 property assessment details can be searched and accessed any time at bcassessment.ca by using BC Assessment’s Find your property assessment online service.

Overall, the Southern Interior’s total assessments increased from about $315 billion in 2024 to nearly $323 billion this year. A total of about $5.29 billion of the region’s updated assessments is from new construction, subdivisions and the rezoning of properties.

BC’s Southern Interior region includes the main urban centres of Kelowna, Kamloops, and Cranbrook as well as all surrounding Okanagan, Thompson, and Kootenay Columbia communities.