Photo of Kamloops Daily Newspaper, Sept. 25, 1990 proclaiming RCMP moving into new headquarters at 6th and Battle/via City of Kamloops

After years of waiting, a recommendation is moving forward on Tuesday for Kamloops City Council to decide on whether to approve the creation of a new home for the Kamloops RCMP detachment.

If endorsed by the political leaders — as well as the taxpayers of Kamloops — the Mounties won’t need to ‘saddle up’ to get to their new posting.

A report going to Council this week is recommending the creation of a new, stand-alone building for the RCMP on the existing plot of land its headquarters are located on a 6th Avenue and Battle Street.

It would be a five story building, and would emerge from the parking lots directly to the west of the existing detachment building.

The proposal is an adaptation of the original planning, which was first launched in 2020 in consultation with E Division — British Columbia’s RCMP leadership based in Surrey.

“Concept 1 sought to undertake major renovations to the existing structure and provide 15 years of potential growth,” noted City of Kamloops staff in an analysis paper going before Council on Tuesday. “Concept 2 sought to undertake minor renovations and provide seven years of potential growth, at which point the building would be converted into a civic services facility.”

Sign outside the Kamloops RCMP headquarters at 6th and Battle/via Paul James

After the initial review got going, all-involved came to the conclusion that neither of those options were optimal, particularly the use of the current building as a frame to build around.

“Upgrading the existing building to current Building Code requirements to meet seismic loads was financially prohibitive, and the existing building would not meet modern post-disaster standards,” noted the review. “Due to the nature of renovating a fully operational building, construction consisted of 13 phases and several rounds of transferring employees to other locations.”

Moving the detachment’s location would also take away from the centralized advantage the 6th and Battle location provides for RCMP rapid response, given the next-to-immediate response times for incidents downtown.

The current location also provides an almost-direct route to both southwest and East Kamloops via nearby Columbia Street.

While strategic in its location, the building itself is getting outdated for RCMP use, as well as overcrowded.

The staff report notes the building was finished in 1990, when the population of Kamloops was around 67,000 people, meaning a lot less demand for policing services at that time.

“The building is approximately 40,000 sq. ft. and was designed for approximately 75–85 occupants. In 1990, there were approximately 80 total employees, with 50 employees on site at a time,” noted the analysis. “The detachment currently has an occupancy of approximately 150 employees.”

With those challenges in mind, the focus then shifted to what’s set to go before City Council on Tuesday.

Kamloops RCMP detachment parking lots as seen from Battle St. (top), St. Paul St. (left), including a fenced off, overflow parking area (right)/via Paul James

“It includes the development of a new five story, 120,700 sq. ft. building at 560 Battle Street, immediately to the west of the existing building,” noted the staff report.

It also notes that if the project goes ahead, work would get underway almost immediately, as projections suggest the earliest the RCMP could shift into the new building would be 2029.

“Operations at the existing detachment will remain in full effect until the completion of the new addition’s construction,” added the report. “At this point, RCMP equipment and staff will be relocated into the new addition, and the existing detachment will be demolished.”

The current building will ultimately be replaced by a two-story parkade.

One of the original concepts was to have the building maintained, but converted into a Civic Operations facility for the City of Kamloops.

However, City staff tell Radio NL growth of the RCMP detachment requires a lot more parking availability for cruisers, as well as on-site maintenance for them, making the on-site parkade area a priority over more space for Civic Operations.

Taxpayers to approve spending

If Kamloops Council gives the green-light to the project on Tuesday, there’s still another hurdle to pass: Kamloops taxpayers.

Due to the size of the borrowing, estimated at just over $150 million, public approvals need to be satisfied before the lending process through the Municipal Finance Authority can go ahead.

Approvals would come either as a referendum or, more likely, through another Alternative Approval Process — the AAP.

While less expensive than a full referendum, the AAP is also a lot quicker.

If the City wants to secure the money for the build this year, it would have to submit its loan request to the Municipal Finance Authority before mid-March, as the MFA only issues loans twice a year — April and October.

If the City did miss the spring intake deadline — but did get approval to borrow through the AAP — it could launch the building process on the expectations it would be getting the loans through reserve funding.

While delaying the process further would likely not sit well with E-Division or the local RCMP leadership, a delay could end up saving the taxpayers money, as the MFA’s financing rate for long-term borrowing for its 2025 spring issue is set 4.08%

While down from the previous spring rate of 4.44% in 2024, the 10-year average — before the pandemic — was 3.69%, with a lending rate as low as 2.2% in the spring of 2015.

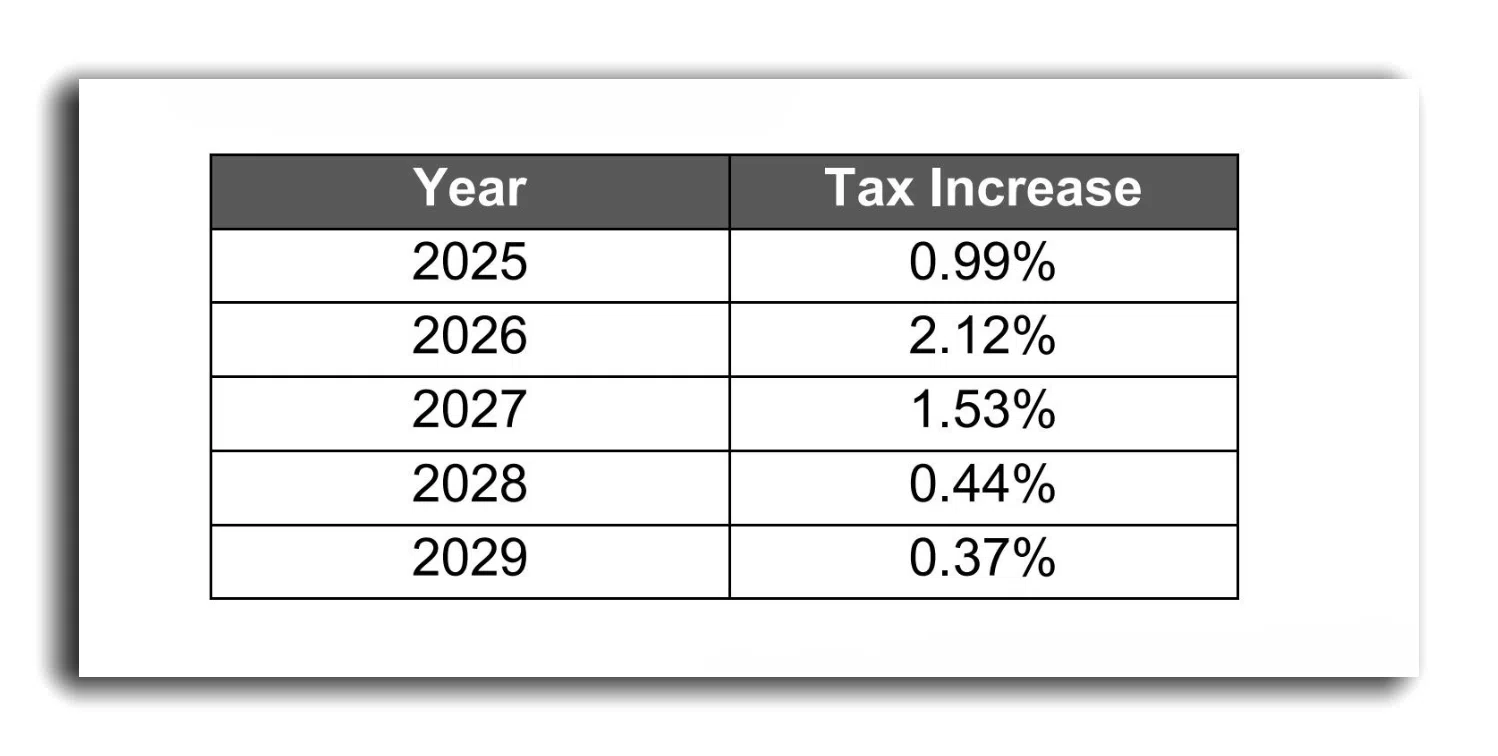

Projected 5 year property tax impact from borrowing to finance proposed RCMP building/via City of Kamloops

If approvals are given on both fronts, taxpayers in Kamloops are going to see the biggest hit come on next year’s tax bill, with the RCMP building set to tack on at least 2% to whatever other tax increases may or may not be contemplated in the coming year.

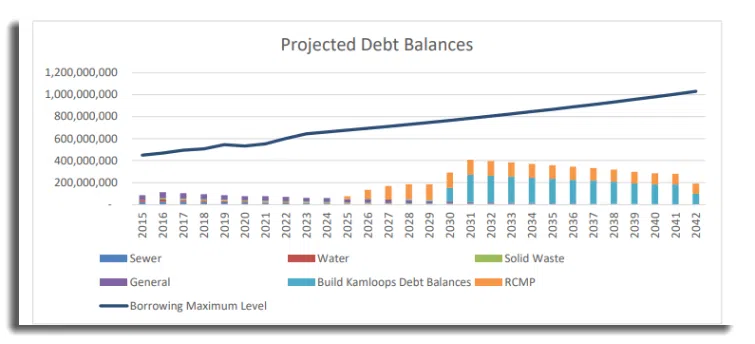

It also adds to a growing amount of overall debt, which the City’s analysis suggests should start to ease back in 2032, after peaking in 2031.

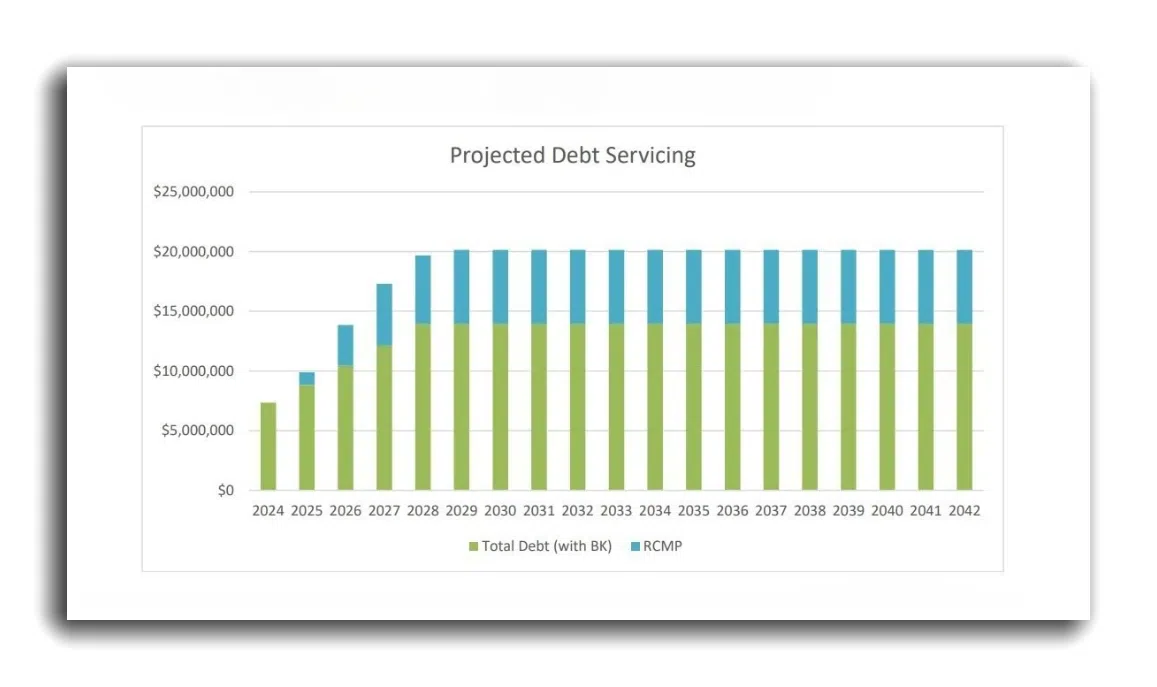

Until that point, the projections note the debt servicing fees will begin climbing from approximately $7.5 million paid into loan interest this past year, which then shifts to around $10 million this year.

By 2028 and the following 14 years until the end of 2041, the cost to keep the municipal debt from growing will be around $20 million each year.

These calculations are based on the standard 30 year loan agreements negotiated between municipal governments and the Municipal Finance Authority for long-term repayments.

Those loans are fixed-rate, but with some ‘wiggle room’ for the MFA to change the terms if it chooses.

“Loans with terms of ten years or longer will generally receive this [projected spring/fall] rate for the first ten years,” notes the Finance Authority. “Typically, at the end of ten years, the relending rate will be reset at the current market rate for a period to be determined at that point (likely five years).”

Graph showing projected impact proposed RCMP building Kamloops will have to pay each year to keep debt from growing/via City of Kamloops

“No” is not recommended

Kamloops ratepayers have been looking at an initial property tax increase this year of 9.67%.

While still considered an ‘initial assessment,’ the nearly 9.7% figure is up from the initial projection of 8.17%

That’s due in part to an unanticipated wage hike in the new RCMP contract settlement with Ottawa.

RCMP cost increases this year in Kamloops also include the five additional officers being put into service, which Council had previous approved.

Should Council and/or the taxpayers reject borrowing for a new RCMP building, a couple scenarios could potentially take hold.

If E Division and Ottawa come to the conclusion that Kamloops is willfully in breach of the Municipal Police Unit Agreement — which each municipality has to agree to in order to get RCMP services — the Province could nullify the policing arrangement entirely.

While highly unlikely and a ‘worst case scenario,’ the more likely option could be for the federal government to step in and take any options out of the City’s and taxpayer hands.

“In exceptional circumstances the Federal Government of Canada and the Province of British Columbia RCMP E-Division could agree to provide and maintain its own infrastructure for the use of the Municipal Police Unit and support staff at 100 per cent costs paid by the City,” noted the City of Kamloops report.

While any City in BC with over 15,000 residents is supposed to pay all of the RCMP’s costs in their community, the provincial government usually picks up around 10% of those costs through various areas of support, which would most likely disappear in this scenario.

A loss of that 10% stipend would cost the City around $4.4 million dollars a year.

By comparison, the added $1.77 million in unanticipated costs from the RCMP’s salary bump last year saw the initial property tax assessment for this year rise by just under 1.2%.

Those extra costs could also impact the City’s plans to slowly start knocking down the debt its been incurring through Build Kamloops and other loans.

That is expected to slowly start taking place after 2031, where debt will peak at around $400 million.

The City plans to have half of that debt paid off by 2042.