Not a lot of precise detail in the latest financial hit from Washington, but sources tell Radio NL that a notification on Saturday afternoon from Premier David Eby’s office is a confirmed calculation: The US Commerce Department is planning — at least for now — on hitting Canadian softwood lumber with duties of 34.45% later this summer.

This is well more than double the current 14.40% rate that Canadian lumber exporters are currently being forced to charge to try to get their products across the border.

Sources tell Radio NL this new 34.45% figure is based on the delayed countervailing duty the US Commerce Department had been working on finalizing.

It’s said to be made official on Monday.

The same sources tell Radio NL the duties for Canfor, Canada’s largest lumber producer and exporter, are going to be set in the 47% range for the combined anti-dumping and countervailing calculation.

This would suggest the yet-to-be-revealed countervailing duties being slapped on Canfor are in the 12 to 13% range.

On the other side of the calculation, West Fraser Mills’ countervailing duties from the US Commerce Department on Monday are likely to be higher than Canfor’s — somewhere in the 16.5% range.

While substantial, the initial figures are within the 30-35% range industry observers and insiders have said they were expecting this year as the US Commerce Department began its ‘annual’ investigation.

Trump could still add to hit

There is still the realistic possibility the Trump administration could tack on its own tariff, which could push the price to secure a bond for Canadian lumber at the US border even higher.

Despite the new calculation from the US Commerce Department, precedent would dictate that any move by the White House to target BC and Canadian lumber directly would be concurrent.

When the Trump administration first introduced — then subsequently paused — its initial 25%, across-the-board tariffs on Canada and Mexico in early March, those were on top of the 14.4% duties already in-place from the US Commerce Department.

While alarmed, the industry had already been preparing for its 30 to 35% hit and – by most indications from industry representatives and government officials – weren’t ready to “hit the panic button” at that point.

Premier David Eby holds a news conference on the grounds of the Legislature to talk about BC’s response to the tariff threats from the Trump Administration on March 4th/via David Eby Flickr

The move was still enough of a threat to prompt Premier David Eby into plans for a surcharge on trucks — and possibly tourists — from the ‘Lower 48’ States coming across the BC border trying to get into neighboring Alaska.

With that, and likely other factors at play, a day after hitting ‘pause’ on his plans for the sweeping 25% tariff regime on Canadian (and Mexican) imports, Trump would set another series of steps in motion by singling out the Canadian lumber and dairy sectors as areas ripe for his brand of economic equilibrium.

A statement from Trump in the Oval Office on Friday, March 7th, threatened the Canadian lumber and dairy industry with an impending, now-stock market-like signature on a Presidential Order for one week later.

“Canada has been ripping us off for years on lumber and on dairy products,” the US President told reporters gathered in the Oval Office on the Friday afternoon, suggesting at that point a dollar-for-dollar counter surcharge.

“We may do it as early as today [March 7], or we’ll wait until Monday or Tuesday,” threatened Trump. “We’re going to charge the same thing. It’s not fair. It never has been fair, and they’ve treated our farmers badly.”

But as this was taking place, the Premier of Ontario was also doing a bit of flexing of his own, which ultimately caught the attention of the administration.

Doug Ford first cancelled a Starlink contract worth over $100 million to Trump’s efficiency tzar Elon Musk, then took it a step further after that weekend by announcing plans the following Monday, March 10th, to hike electricity rates for Michigan, Minnesota and New York in retaliation for the continued threats.

Neither threat ever materialized, however, as US Commerce Secretary Howard Lutnick would intervene and cool down the rhetoric with an invitation for Doug Ford and the remanence of the Trudeau cabinet to sit down and hash things out in Washington.

While details of those discussions have not been made public, we do know those talks did not involve any BC government ministers and brought on a far-less antagonistic approach by Trump himself in the aftermath.

However, the transition from Trudeau to Mark Carney was getting underway, which may have also influenced the mindset of the US President.

BC can afford to wait on penalties

While provincial officials are said to have the broader details of the new softwood countervailing calculations in-hand, the US Commerce Department is expected to roll out the finer details on Monday.

“This is basically break-up,” noted Kamloops-North Thompson MLA Ward Stamer, who is the BC Conservative’s opposition Forests critic.

Workers processing plywood at the Heffley Creek sawmill in the north Thompson/via Heffley Creek Mill

The former mayor of Barriere, who worked for and eventually ran his family-owned logging company, suggests the timing of the updated countervailing hit is not likely to force the hand of mill owners in the Kamloops region.

“Most of the people who work in the bush are actually working on their equipment right now,” noted Stamer. “The mills have already got two- or three-month’s worth of wood that they can either turn into lumber and plywood, should they so choose.”

Despite this time of year being somewhat resilient when it comes to layoffs in the forest sector, there is a level of uncertainty within the sector, which itself could be a factor in some local mills going down for an extended period of time, or permanently.

Stamer warns that while certain industry players are likely to hold off on any cutbacks for the time being, others may be pushed to the edge, depending on how close they are to their own boom-or-bust line.

This comes as the US side had already been signaling both up front, as well as behind the scenes, that with the new Trump administration, the normal course of business — even in a trade dispute — were not to be expected.

A possible indication of this was a separation of the anti-dumping and countervailing rulings, which would normally have been issued together.

The splitting of the initial rulings into separate components and announcements by the Commerce Department did catch some in the forest sector off-guard.

But while eyebrow raising, it does fall well within the Commerce Department’s rights, as the two investigations — now considered in Canada synonymous with one another — are actually meant to be two separate reviews.

What didn’t come as a surprise was the ultimate outcome of the probes.

“This latest decision is based on the sales numbers from only two Canadian companies in the United States,” BC Forests Minister Ravi Parmar told Radio NL hours after the first anti-dumping determination came down.

“The US Department of Commerce continues to really make things up and continue to say that we are incentivizing our industry here, which is not the case,” said Parmar at the time.

Nearly century-old law basis for investigation standards

The US Commerce Department wields its power over foreign importers in anti-dumping and countervailing cases on legislation which came into effect in 1930.

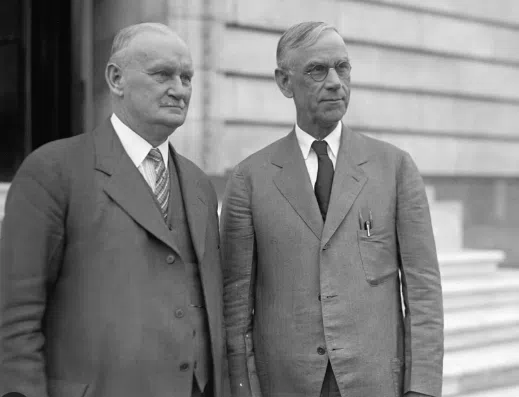

Republican congressmen Willis C. Hawley (L) and Reed Smoot (R), who championed the creation of what would become the US Tariff Act of 1930/via Wikicommons

Officially named the US Tariff Act, the law is better known by historians and economists as the Smoot-Hawley Tariff, which was brought in as a protectionist measure during the start of the Great Depression.

While it has been modernized over the years to comport with international trade policies, the foundation of the law remains rooted in protectionism and gives the US Commerce Department a wide berth to conduct investigations the way it chooses to.

That includes applying different standards based on what the investigator determines is the best way to get the investigations done, and in the most efficient and convenient way.

While convenience may not have been the overriding factor, in the latest US probe into Canadian lumber sales, the US Commerce Department decided to include just two companies — Canfor and West Fraser.

These are Canada’s largest forest companies — both of which are headquartered in Vancouver and provide direct and indirect jobs to thousands of British Columbians, as well as hundreds of Americans and some Swedes as well.

Those two companies have been the primary focus of every anti-dumping and countervailing probe since the expiry of the previous Softwood Lumber Agreement in 2015 and the re-start of the sanctions.

Questions raised about probe parameters

“But let me, let me just be very clear,” stated Ravi Parmar in conversation with Radio NL at the time the initial anti-dumping recommendation was put out. “This latest decision is based on the sales numbers from only two Canadian companies in the United States.”

“The US Department of Commerce continues to really make things up and continues to say that we are incentivizing our industry here, which is not the case.”

By choosing to go with just two companies in this latest investigation, the US Commerce Department did break from its normal procedure.

That had been choose at least three or four different Canadian firms to be part of its annual review.

While putting an emphasis on the two largest Canadian firms operating in the US does make sense from an import control level, by not including any other companies, the US Commerce Department is being accused of ‘putting its thumb on the scale’ when it comes to the remedies it intends to apply.

A truck hauling raw logs on a logging road in British Columbia/via BCTLA

This is because of the way in which industry-wide penalties are calculated, which is in stark contrast to the methodology used to calculate the “injury” to US industry interests.

The investigation procedures used to determine whether “dumping” is taking place are extensive and detailed, though ultimately tilted against the Canadian side.

However, they are based on the data provided by the US industry, which has the ability to be strategic in the data points it collects and provides as evidence of “injury,” and also has a full year to collect the data it wants to show Commerce officials.

Canadian firms are given far less time to compile a defense — a maximum of 2 months, should they decide to participate in the exercise, which is based largely around subject companies being asked to fill out a long series of forms and surveys.

The probes are based around Customs data, industry averages, sales trends during the time period in question, on top of the cost of production and shipping, along with a variety of other factors.

The mathematical tools the US Commerce Department uses to analyze the data are considered reliable — in this case a “Cohen’s d test,” combined with a “ratio test.”

While thorough in its investigations, the US Commerce Department’s way of calculating penalties for a broader industry — such as the Canadian softwood lumber sector — is far less nuanced.

Once a determination on “dumping” or “countervailing” has been calculated, the preliminary and final penalties for a broader industry, such as the softwood lumber sector, are not based on what an individual company (except for those involved in the investigation) may or may not have done.

Instead, US Commerce Department policy is to take the level of “harm” it has calculated from each company involved in the probe, then essentially add the percentages up and divide by the number of companies involved in the probe itself.

While there are a few factors which may impact that generalized approach, the basis of the determinations, both initial and final, are rooted in that basic math.

The fewer companies involved in the review, the more likely it is that the final numbers will be skewed toward the high side, as there’s no third or fourth party to in the calculation to dilute the percentages.