A look at the Bush Creek East Fire in the Sorrento area around 9pm, Aug. 18, 2023. (Photo via CSRD)

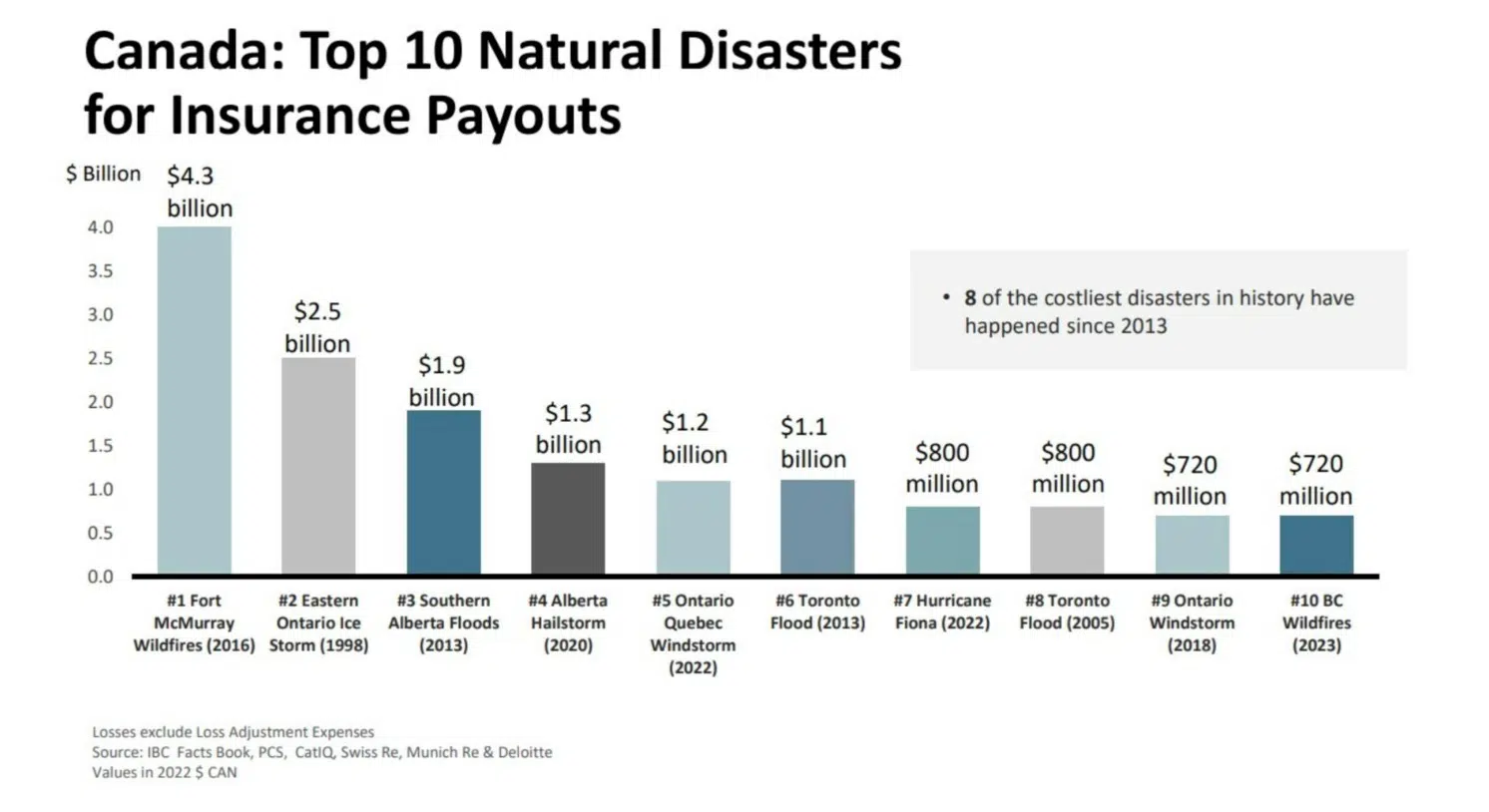

The Insurance Bureau of Canada says this summer’s wildfire season in British Columbia was the costliest disaster in the province in terms of insured losses, and tenth costliest in Canada.

It says the devastating wildfires in the Shuswap and the Okanagan resulted in $720 million in insured losses, according to estimates from Catastrophe Indices and Quantification Inc.

The Bush Creek East in the Shuswap is estimated to have caused over $240 million in insured damage, while the McDougall Creek in West Kelowna caused over $480 million in insured damage.

As a comparison, IBC says the last major wildfire in Okanagan Mountain Park near Kelowna in 2003 resulted in $200 million in insured damage.

“This year’s wildfire season has broken all records in terms of the amount of land burned and damage caused to homes and businesses in BC,” Aaron Sutherland, Insurance Bureau of Canada’s Vice-President, Pacific and Western, said. “Our hearts go out to every individual and family who has been impacted by these wildfires, and to the firefighters who lost their lives helping to protect our communities.”

“The wildfires’ impact is another tragic reminder of the risk BC residents face due to climate change and the increasing frequency of natural catastrophes.”

More than 270 structures are confirmed to have been destroyed by the Bush Creek East Fire, the majority coming on Aug. 18 when winds caused the fire to go on a 20-kilometre run through the North Shuswap.

That fire also caused extensive damage to public infrastructure like BC Hydro poles, leading to power outages and contaminated fridges and freezers.

According to the Insurance Bureau, West Kelowna officials confirmed that 70 homes were affected by the wildfires, and 20 were lost in Westbank First Nation. In the areas of Traders Cove and Lake Okanagan Resort, an estimated 100 structures were completely destroyed. The Lake Okanagan Resort was also destroyed.

In Kelowna, three homes and two outbuildings were completely destroyed, with a further three being destroyed in Lake Country.

“Canada’s insurers are here to help their customers rebuild following this devastating loss,” Sutherland added. “Wildfire damage is covered by all standard home and business insurance policies, and anyone who has been affected by these events or has questions about their coverage should call their insurance representative.”

People with general insurance questions can also contact IBC’s Consumer Information Centre at 1-844-2ask-IBC.

A look at the to 10 disasters in Canada in terms of insured losses. (Photo via Insurance Bureau of Canada)